The Treasury Department and Internal Revenue Service announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended to May 17, 2021.

ReFUND Colorado is still an option for eligible organizations until the May 17 deadline. This means that your communities can still choose to give part of all of their tax refund to the nonprofit sector.

This year, Coloradans will again have a chance to donate from their state income tax refund to a local nonprofit they trust, such as Eagle River Watershed Council.

Through the Donate to a Colorado Nonprofit program, taxpayers can choose to support any eligible Colorado-registered charity with a simple designation on their state income tax return. Previously, taxpayers could choose only from one of 18 causes approved by the Colorado Legislature.

If you are due a Colorado income tax refund or are assisting with tax preparation, taking action is simple:

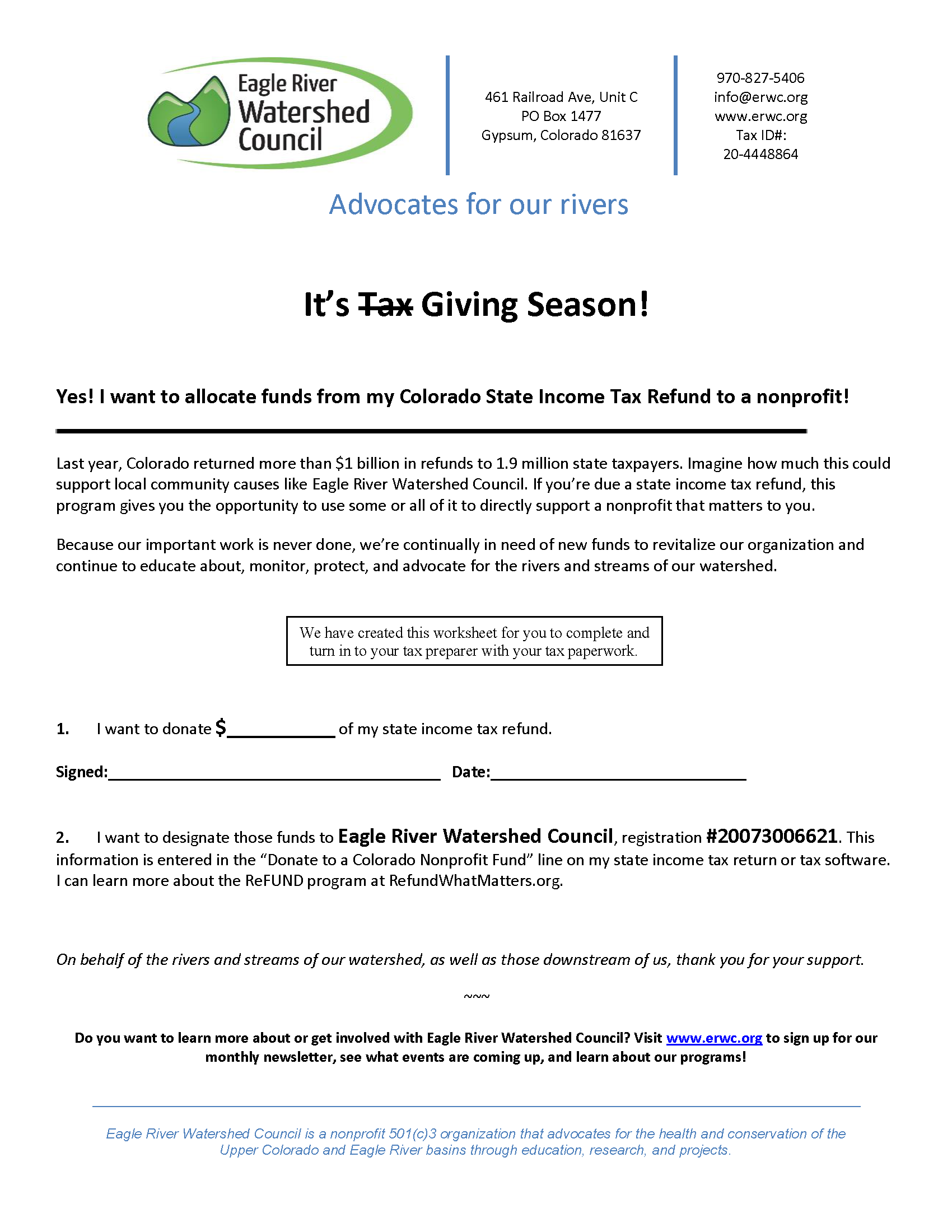

- Decide how much of your state income tax refund to donate (all or a portion of it).

- Enter “Eagle River Watershed Council” and our registration number “20073006621″ in the Donate to a Colorado Nonprofit Fund line on your state tax return or tax software – or give this info to your tax preparer when you share your tax documents.

We made a handy sheet you can print off and turn in to your tax preparer with this information – just download and print or email to the preparer along with your tax documents!